by webSaver

May 13, 2024

Share

Canadians have a reputation for being friendly and polite, perhaps we should add tidy and clean to that mix if the latest webSaver marketing research mini-study on ‘Spring cleaning and home cleaning products’ is any indication.

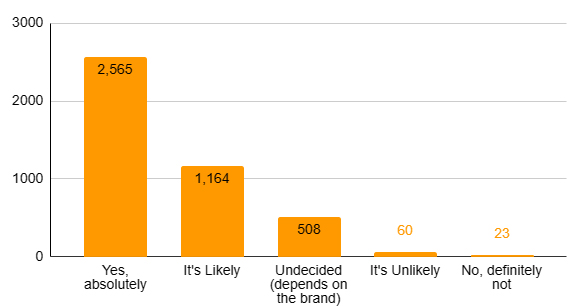

According to our latest study 86% of Canadians answered Yes, absolutely or It’s Likely on whether they plan to undertake spring cleaning activities in 2024, with a focus on decluttering and organizing (22%) and primarily in the major living spaces (Living Room and Bedrooms) at 41% followed by the kitchen at 32%. 36% of them prefer to use a mix of both general and all purpose cleaners. And a significant 60% would try a new Cleaning Brand if a Coupon or Cashback Offer was available. Read on to find out more.

As the owners and operators of webSaver.ca, the leading Online Coupons and Cashback Offers website in Canada, our more than one million members comprise one of the largest, best informed and most active grocery shopper communities in Canada. For these reasons we regularly conduct topic specific market research, such as this survey on cleaning products, or larger more engaging consumer attitude surveys for leading brands interested in better understanding the mindset of the Canadian grocery consumer.

The webSaver.ca membership base is one of the deepest and richest independent grocery data sets in Canada. In addition to data measurement by Location (Province, City, Region), Gender, Age and Language we have deep transactional and behavioural data on dozens of consumption categories including Fruits and Veggies, Snacks, Dairy, Bakery, Condiments, Meats, Home products and much more.

Does your Brand need to better understand the attitudes of Coffee drinkers in Ontario? Canadian Vegans? Mobile First Grocery Cashback Consumers? Chocolate Lovers? Or whatever your specific requirements webSaver can help you get answers.

Contact Us to find out more.

Spring Cleaning and Home Cleaning products Survey Results:

(Aggregate All Canada Data displayed below – Results can also be broken out by Location, Age, Gender and Language to discern group differences)

1.) Will you be engaging in spring cleaning activities this year? (Please select one)

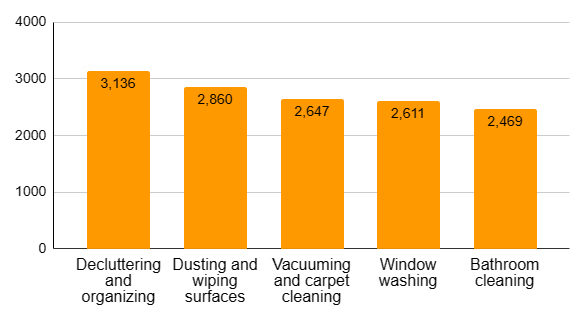

2.) Which tasks do you prioritize during your spring cleaning routine? (Please select all that apply)

3.) Which area of your home takes the highest priority during your spring cleaning routine? (Please select one)

4.) Do you use specialized cleaning products for different tasks during spring cleaning? (Please select one)

6.) Would you try a new cleaning brand if there was a coupon or cashback offer available? (Please select one)

Additional insights gained from reporting results by demographic variables:

In addition to the aggregate ‘All Canada’ results above we can also break out the results by demographic category, by consumption category, or both. This allows us to obtain more granular insights such as:

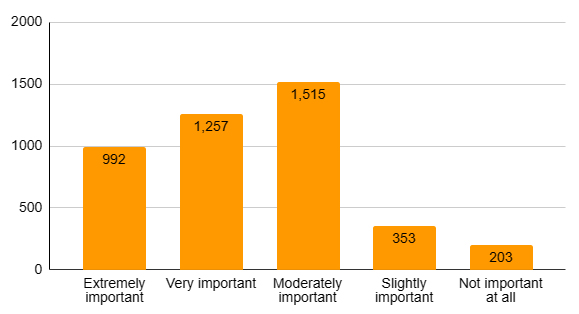

- When choosing household cleaning products 17% of Albertans consider it extremely important that products are sustainable and eco-friendly versus 24% of Ontarians.

- Differences in attitudes also exist in Age groups whereas only 17% of the 55+ cohort considers it extremely important compared to 29% of the 25-34 group.

- Women seem to be slightly more open minded to trying new brands with 60% saying Yes, they would absolutely try a new brand if a coupon or cashback offer was available, whereas 55% of men said they would do so.

- 59% of English Canadians answered that Yes, they absolutely plan to undertake Spring Cleaning activities this year versus 44% of French Canadians.

- In most of Canada common living spaces are the primary area of focus in spring cleaning ranging from 51% in the Maritime provinces, and 48% in SK, AB and BC. Whereas in Quebec the Kitchen and dining area is by far the most important at 42% with common living spaces only at 28%.

- It seems younger consumers are more likely to be influenced by the availability of a coupon to try a new Brand with the percentages answering ‘Yes, Absolutely’ to question 6 as follows:

- 18-24 63.04% / 25-34 60.57% / 35-44 61.99% / 45-54 60.78% / 55+ 54.33%

- And so many more.

Savvy Brand Managers understand the importance of gaining insights into their consumer’s mindset and conducting surveys is a straightforward and simple manner to obtain feedback into consumer preferences and attitudes.

Work with the experts at webSaver and put our leading Canadian Grocery data set to work for your Brand.

Contact Us to find out more.

View some recent market research insights from webSaver here.

With over 10 years leading the Canadian online coupons marketplace and 150 Million coupon issued we know coupons. We’ve worked with 90% of Canada’s leading consumer packaged goods brands providing them with the online coupons and cashback offer solutions that generate real value for their business. Whether your strategic objective is customer acquisition, customer lift (Increased transaction size and frequency) or customer retention webSaver can help.