by webSaver

August 1, 2024

Share

As owners and operators of webSaver.ca, the leading Online Coupons and Cashback Offers website in Canada, our more than one million members comprise one of the largest and most active grocery shopper communities in Canada. As such they provide Brands with invaluable market research insights into Canadian consumer behaviour.

We recently conducted a brief market study on Canadian behaviours and attitudes towards Oral health and hygiene Brands to identify what oral health products Canadians buy most, their degree of brand loyalty and their likelihood to seek and be influenced by brand promotions such as coupons and cashback offers.

In a nutshell, Canadians are loyal to their preferred oral health brands (60% ‘Extremely or Very Loyal’) and are consistently seeking ways to save money on these brands (79% ‘Always or Frequently Seeking’). But they are also very open to try new brands if they can find promotional offers (82% ‘Very Likely or Likely’).

Additional highlights from the study are below. These insights can help Brands design targeted marketing strategies, optimize promotional campaigns, and better understand consumer motivations in the oral health market.

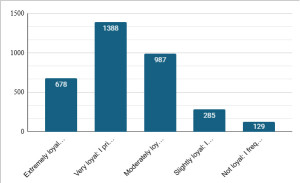

- A significant portion of respondents show strong brand loyalty, with 59.6% being very or extremely loyal to their preferred brand and only 3.7% are not loyal at all.

- Consistent promotional offers significantly influence brand loyalty, with 86% being likely or very likely to remain loyal if brands consistently offer coupons and cashback incentives. Only 1.5% are unlikely to remain loyal due to offers.

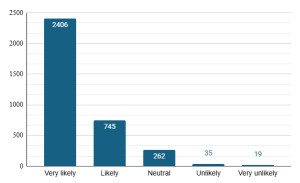

- Coupons and cashback offers are highly effective in influencing purchase decisions and driving brand switching, with 81.7% being likely or very likely to try new products if there are enticing offers. Only 2.9% are unlikely to switch due to offers.

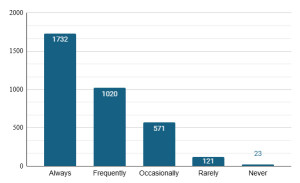

- Consumers are actively seeking Coupons and Cashback Offers with half of the respondents (50%) always seeking out coupons or cashback offers, and nearly 80% doing so at least frequently and occasionally. Only 0.7% never seek out these offers.

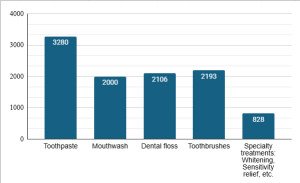

- Toothpaste is the most regularly purchased product, followed by toothbrushes and dental floss.

- Read on to find out more.

Oral Health and Hygiene products Survey Results:

(Aggregate All Canada Data below – Results can also be broken out by Location, Age, Gender and Language to discern group differences)

1.) Which oral healthcare products do you purchase on a regular basis? (Select all that apply)

2.) How would you describe your level of loyalty to oral health and hygiene products? (Please select one)

3.) How likely are you to use coupons or cashback offers when purchasing oral healthcare products? (Please select one)

4.) How often do you actively seek out coupons or cashback offers for oral healthcare products? (Please select one)

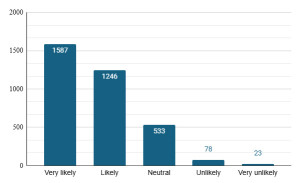

5.) How likely are you to try a new oral healthcare product or switch brands if there are enticing coupons and cashback offers available? (Please select one)

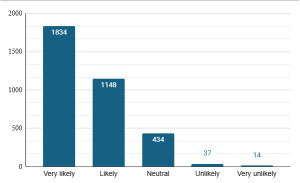

6.) How likely are you to remain loyal to an oral healthcare brand if it consistently offers coupons and cashback offer incentives? (Please select one)

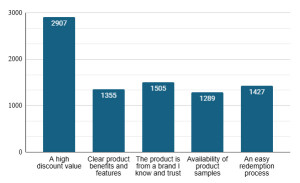

7.) What would make you more likely to redeem a coupon or cashback offer for a new oral healthcare product? (Select all that apply)

Additional insights gained by drilling down into various reporting categories:

In addition to the aggregate ‘All Canada’ results we can also break out the results by demographic category, consumption category, or both. This allows us to obtain more granular insights such as:

- French speaking consumers tend to display higher levels of loyalty (70% Extremely or Very Loyal) than English speaking consumers (58% Extremely or Very Loyal).

- There seems to be a direct linear relationship between age and consumers being ‘Very Likely’ to try a new oral healthcare product or switch brands if there are enticing coupons and cashback offers available, with the youngest consumers (18-24) being the most open and the (55+) cohort being the least open as follows:

- (18-24, 53% ), (25-34, 50%), (35-44, 46% ), (45-54, 44%), (55+, 43%).

- And so many others. The capabilities are there depending on a Brand’s informational needs.

The webSaver.ca member base is one of the deepest and richest independent grocery data sets in Canada.

In addition to data measurement by Location (Province, City, Region), Gender, Age and Language we have deep transactional and behavioural data on dozens of consumption categories including Fruits and Veggies, Snacks, Dairy, Bakery, Condiments, Meats, Home products and much more.

Does your Brand need to better understand the attitudes of orange juice drinkers in Quebec? Soccer Mom Snack buyers? Meat Lovers? Vegetarians? Or whatever your specific challenge webSaver can help you get the answers you need to make better informed decisions.

Contact webSaver Market Research Solutions to find out more.

With over 10 years leading the Canadian online coupons marketplace and 150 Million coupon issued we know coupons. We’ve worked with 90% of Canada’s leading consumer packaged goods brands providing them with the online coupons and cashback offer solutions that generate real value for their business. Whether your strategic objective is customer acquisition, customer lift (Increased transaction size and frequency) or customer retention webSaver can help.